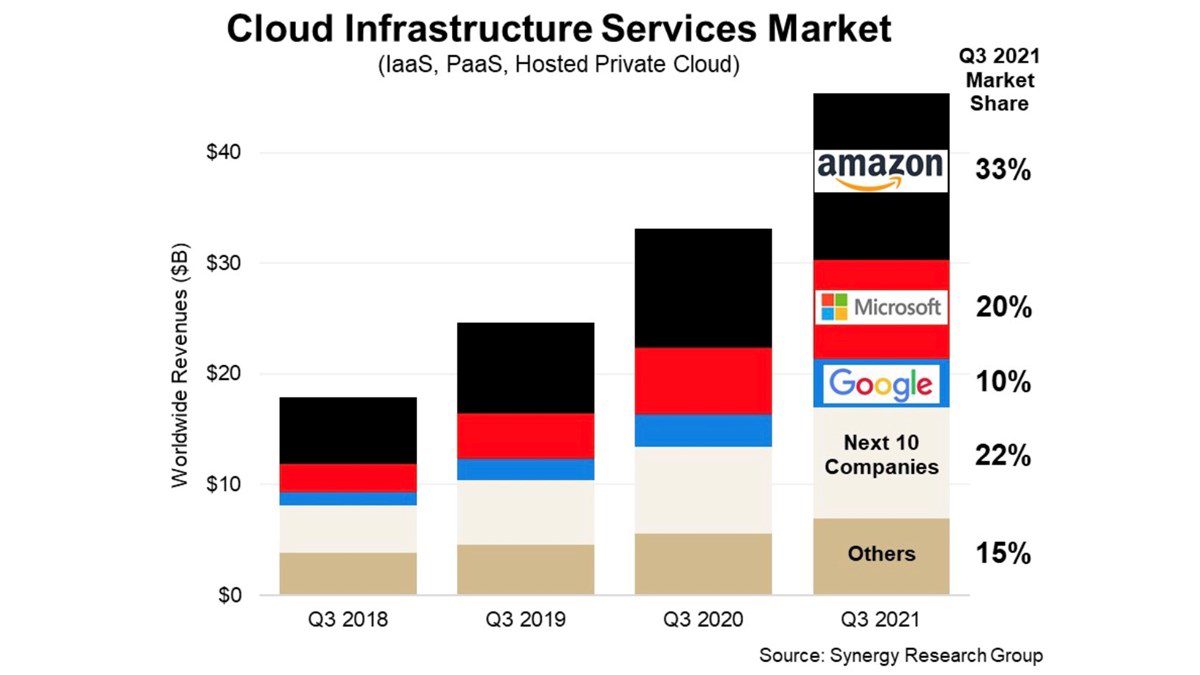

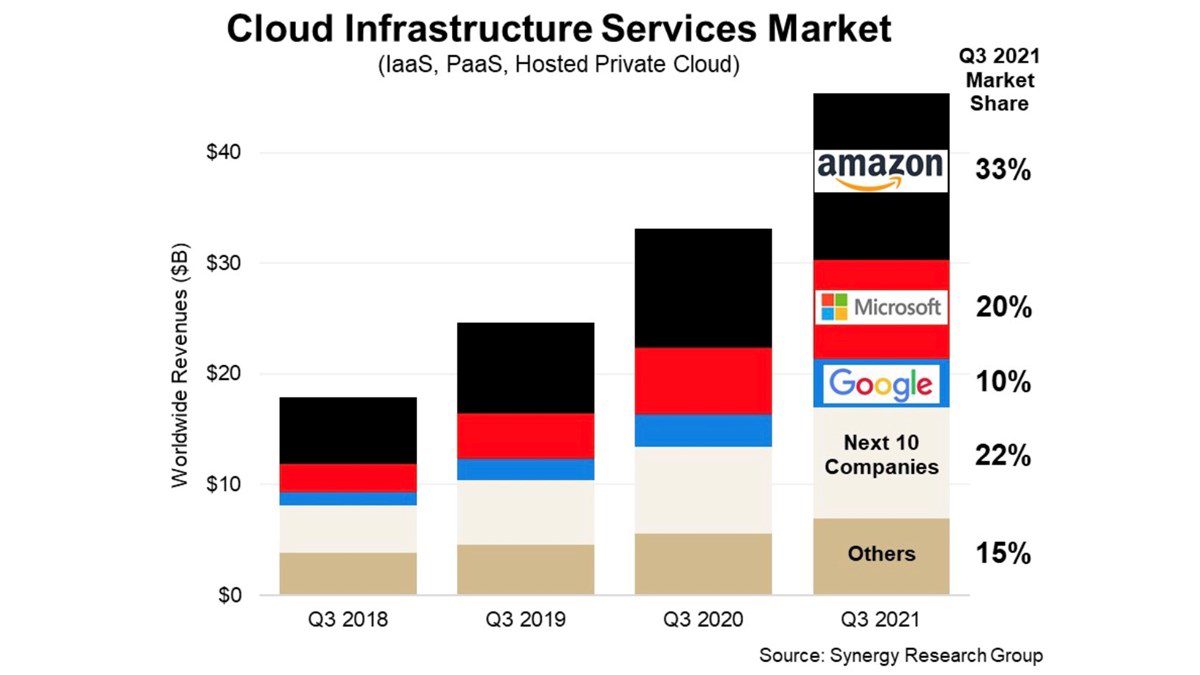

The global cloud market continues to grow at an exponential rate with enterprise spending on cloud infrastructure exceeding the $45 billion mark in Q3 of 2021, which is more than a 37% increase in the same quarter in 2020 fuelled by a growing range of cloud offerings for businesses to consume. Amazon and Microsoft continue to dominate nearly 55% of the entire cloud market, so the question that you will ask yourselves is AWS vs Azure which is best for my workload? And that is the reason we have written this guide which will help to distinguish between these two behemoths of the cloud and provide some insight as to the different capabilities offered by each.

The ability to keep abreast of the innovation and drive for cloud computing on a global scale will mean that this guide captures the current landscape at publication, and will exclude products and features added through the consistent and frequent product launches from both Microsoft Azure and Amazon Web Services. Product diversification amongst the major players designed to cater for both established and growing markets from Public Preview to General Availability will expand as offerings continue to be announced. This overview helps provide a general understanding of each of the platforms available from a public cloud perspective.

AWS vs Azure – Infrastructure footprints

Both Microsoft and AWS have extensive global data centre footprints with fibre optic and undersea cable infrastructure to interconnect and encourage onboarding from customer premises and data centres directly to their cloud ecosystems – through either Microsoft ExpressRoute or AWS Direct Connect. They both provide 100GbE Fibre networks across their backbone facilitating geographically separated operational footprints for organisations by allowing redundant transfer of data between regions and availability zones.

To create a starting point for analysis of AWS vs Azure, we’ll attempt to provide as much information as possible around the underlying infrastructure, global data centre deployments and connectivity to help create a broader picture for each of their clouds. Some of the information below is limited based on findings but provides a picture of each of the different platforms.

-

Comprised of 200+ physical data centres, coordinated by regions and linked by interconnected networks.

-

Approximately 60+ Microsoft Azure Regions

-

165,000 Miles of Fibre Optic and Undersea Cable infrastructure

-

185 Global Network PoPs – which also incorporate onramps to their cloud platform.

-

Comprised of 310+ Points of Presence, including 300+ edge locations and 13 Regional Edge Caches

-

Approximately 84 Availability Zones across 26 Launched Regions

-

108 Direct Connect Locations which provides onramps to their cloud platform from third party data centres such as Equinix.

Both public cloud providers provide a map overview of their global infrastructure, allowing customers to review locations prior to utilising their service.

Microsoft Azure – Network Map

Azure Global Infrastructure (microsoft.com) allows you to explore the global to view Azure Regions, Edge Zones, Network PoP, WAN links and more. This is a great viewpoint to understand whether Azure operates in your country and allows you to drill into each zone to view products, Disaster Recovery and compliance information.

Amazon Web Services – Regions Maps and Edge Networks

Global Infrastructure Regions & AZs (amazon.com) – this page drills down further into each of the applicable regions, providing both the regions of presence, edge locations and applicable availability zones. There is also information surrounding edge locations showing where customers can on-ramp to AWS cloud services.

Now we have presented the basic elements of both providers let’s examine why the public cloud is so appealing to businesses? Firstly, the financial commitment around provisioning infrastructure is a massive inhibitor to adopting technical solutions to support a business, so the ability to remove capital expenditure around running equipment internally and replace it with on-demand or reserved compute becomes very appealing.

The cost can be aligned directly to a line of business through OPEX (Operational Expense) removing the need for underlying infrastructure CAPEX (Capital Expense) to be purchased. The flexibility of these models is designed to suit most budgets, which is where the different pricing structures available are worth exploring.

AWS vs Azure – What are the different pricing models for the public cloud?

Both major cloud providers provide consumption based pricing models for virtual machines, storage and network. So, comparing AWS vs Azure we will go briefly into each of these starting with compute and how each cloud provider offers it.

On-Demand – available under both Azure and AWS

On-demand is one of the most popular iterations when it comes to consumption of public cloud compute, essentially this model works by offering the user the ability to consume services when required by the hour or even by the second. There are no long term commitments and comes with the ability to turn off and on services depending on the business requirement or your application needs.

When to choose on-demand

On-demand is best suited for businesses that prefer both low cost and flexibility without long term commitments or up-front payments. Additional it works best for applications that require short term or unpredictable workloads that can’t be interrupted. It also is ideal for running dev and test applications in a siloed environment to an on-premise instance. The consideration for services using on demand is that when turned off unless backed up they are lost and need to be rebuilt from scratch.

This is likely to be an appealing factor to businesses who have been adding or bolting on licenses to an existing tenancy by removing the need for these “Plan 1 or Plan 2” license costs and merging under a single Microsoft 365 Business Premium license. This move from Microsoft could also encourage the conversation within businesses to migrate away from third party tools to a single management console under the Microsoft 365 Defender Portal.

Reserved Instances – available under both Azure and AWS

Public cloud reserved instances are used where it is important to have the footprint and configuration for a sustained amount of time, such as a Domain Controller as the virtual machine will remain operational and is highly unlikely not to be required. Because of its popularity with organisations, a significant discount which in some cases can be up to 72% when compared to on-demand is offered, but requires the commitment of 1 year to 3 year terms albeit with the ability to alter instance sizes within the same group and region while under contract. By committing for longer periods of time the public cloud providers have the ability to resource the platform accordingly, which therefore means they can incentivise businesses with larger discounts over hourly billing available through on-demand.

When to choose Reserved Instances

The balance is when to use reserved instances over on-demand such that if a particular workload is considered Business as Usual or won’t be replaced for a sustained period, then a 1 year or even 3 year reserved instance should be worth considering.

Amazon Web Services offer 3 different reserved instances – 1) Standard reserved instances for steady-state usage and provide discounts up to 72%. 2) Convertible reserved instances allow customers to change attributes as long as the newer resource group (essentially consumption) is equal or more than the original reserved instance and 3) Scheduled reserved instances which enable the ability to launch services within particular time frames.

Microsoft Azure offers a similar model with regards to reserved instances allowing customers to reserve virtual machines with the aim to reduce overall costs, these can too be flexible to exchange instances across any region or any series depending on how your workload changes. There is also the ability to cancel these instances and return the remaining months back to Microsoft with an early termination fee.

Spot Instances – Available under both Azure and AWS

Purchasing “Spot” Instances allows businesses to consume unused capacity in the public cloud providers environment, although should be only considered where interruptions and tasks don’t need to be completed within a certain time period. The benefit of this is being able to achieve up to 90% discounts compared to pay-as-you-go prices.

Both cloud providers have the ability to provision this service under the same model, where if the price currently is higher than the maximum price set then the machine will turn off similarly based on available compute capacity and Azure/AWS’s need to reallocate resources.

Microsoft Azure provides the ability to review pricing and eviction history based on historical data allowing businesses to make an informed decision as to whether their maximum price is achievable.

Although there may be some alternative pricing models under both the Microsoft Azure and Amazon Web Services banner, the 2 main pricing structures consumed tend to be based on the On-Demand and Reserved Instances which achieve the necessary scalability and flexibility for core workloads

AWS vs Azure – Free Public Cloud Trials

If you are looking to trial one of the public cloud platforms, both providers also offer free virtual machine services with 750 hours of both Linux and Windows instances being available to consume each month over a 12 month period, so being able to test these platforms is possible although limited by the underlying infrastructure present in the virtual machines below;

AWS offer a Linux or Windows t2.micro instance providing 1vCPU, 1Gb Memory and low to moderate network performance

Microsoft Azure offer a Linux or Windows B1s Burstable virtual machine providing 1vCPU, 1Gb Memory and 4Gb temporary storage.

This guide forms part of a series that will continue to dive into each of the services available through each of the public cloud providers, whereby virtual machines, storage, networking and other instances will be compared to allow for a transparent view of the offerings under these major players.